People are bad at estimating. We oversimplify to get faster answers. We average out complexities because they can’t fit neatly into our model. Unresolved problems are uncomfortable. It’s inconvenient to wait for data so we quickly move things along. We create starter solutions. We label things work in progress. We propose temporary solutions and acknowledge that things will change over time as we collect more information. We say we’ll get better as we go along.

Then, inertia takes over. The first takes become the standard. The imperfect model morphs into guidelines and “the way it’s always been done.” Systems are built around the original findings. When the rest of the data comes in, when base assumptions are proven as flaws, when extra external factors are included — it’s no longer seen as a progress of knowledge, but as a challenge to convention.

Here are two such challenges I found this weekend. Carbon offset credits for preserving forest land are coming up short on the amount of carbon dioxide they actually sequester. The real estate market in the United States is not properly accounting for flood zones.

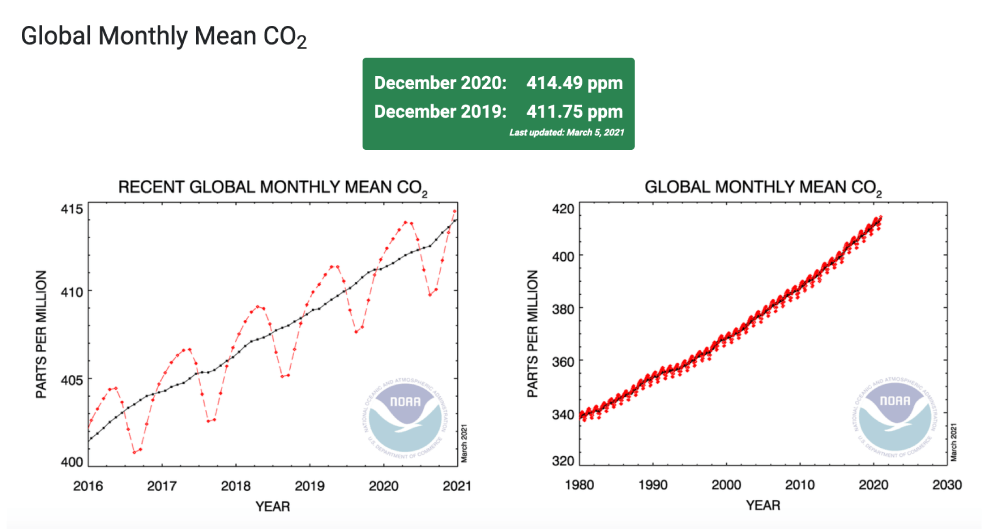

That’s because the state was using averages to estimate how much CO2 each parcel of forest could hold. In reality, some pieces of forest can store more than others based on what kinds of trees are there and how dense the forest is. Forest managers also “gamed the system” by selling credits from parcels that inflated how much carbon they stored, ProPublica and MIT Technology Review reported.

By Justine Calma at The Verge

Our findings indicate that houses in flood zones in the United States are currently overvalued by a total of $43.8 billion (95% confidence interval: $32.6 to $55.6 billion) based on the information in publicly available flood hazard maps alone, raising concerns about the stability of real estate markets as climate risks become more salient and severe.

The effect of information about climate risk on property values